I’m Home

You always hear of those horror stories where passengers are trapped on a plane parked on the tarmac for hours on end. Well, I was lucky. That was the road I and my fellow compadres were traveling down, but 20 minutes after I posted my earlier story, the Captain came on the intercom announcing we could take off now.

Now, onto politics….

I really think John McCain ended his campaign today for all intents and purposes. His stunt in suspending his campaign and requesting a postponement of both his debate this Friday with Obama and the Vice Presidential debate on October 2 are being recognized throughout America and in the media for what it is: A stunt. You should have heard the conversations on the plane I was on. We all in the terminal saw the news and Obama’s response. These are actual quotes I wrote down while listening to the conversations about McCain’s stunt aboard the plane:

“Silly.”

“McCain saw the polls this morning and panicked. Hell, whenever he gets bad news, he panics. What is he going to do in the White House?”

“Johnny Boy is in trouble I guess.”

“Sounds like he doesn’t want to debate.”

“What is he gonna do? The last time John McCain dealt with banking he was part of the Keating Five.”

Barack Obama responded exactly right to this stunt. He correctly pointed out that a President must, by definition, concentrate on more than one issue, more than one crisis, at a time. And he refused to play along with the game of suspending his campaign. Barack Obama will be in Mississippi to address his plans to confront the myriad problems facing America. Whether or not John McCain wishes to join him is entirely up to John McCain. If he does not, he proves that he has no plans. All he has is campaign stunts. Indeed, all John McCain’s campaign has been is stunts. From suspending the gas tax to the selection of Sarah Palin to zig zagging about in response to the Market Collapse of 2008 (first the fundamentals of our economy is strong to “Holy shit we are in trouble, I am a populist now, let’s cancel the election!”)

And let’s say that John McCain does return to Washington to partake in these negotiations. Can his presence be any more than a distraction. John McCain has no experience with the economy, by his own admission. He is not on the banking committee, or on any of the committees currently in negotiation with the Bush Administration on this crisis. Indeed, he has not been in the Senate for months, and has not voted on a bill since April. There is some question as to whether his colleagues will even recognize him.

What John McCain needs to do is debate with Barack Obama about what his plans are to solve this crisis and progress our nation. What we do not need is any more of these panicked and idiotic stunts from John McCain. His latest is insulting to us as American citizens.

—————————————————————

Added: 10:19

Tags: Barack Obama, Delaware, John McCain

It becomes clear. DailyKos is showing that McCain says he won’t debate if there’s no agreement by Friday and that Sarah Palin won’t debate on Oct. 2 if there’s no agreement by then. I assume McCain is going to make sure there’s no agreement by Oct. 2?

What is going on with McCain/Palin. He won’t even let her answer any questions. I guess Campbell Brown got it right there!

http://www.dailykos.com/storyonly/2008/9/24/203734/601/829/609389

Off topic. Bush on now. OMG. What a loser.

Bad Guys: People who got A.R.M’s & Fannie/Freddie

Innocent victims: Goldman Sachs

I could never watch that piece of shit excuse for a President. I like my TV too much.

You must have watched a different newscast than the one I saw.

I heard what happened, what has to be done and how it will work.

I will wait for your reommended actions if you disagree with Pres. Bush’s proposed actions.

I leaning towards… let them fail.

I just finished watching. Did he really say we should recover some if not all of the 700B? If the govt. is going to buy low and sell when the market recovers how does the govt. not make a profit? I’m really confused. I thought this guy had an mba?

DD, I disagree that McCain’s campaign ended today. I believe it ended the day he picked Palin as his VP. He thought he was being so mavericky. And then, the numbers shot up and so did his ego. Then last Monday, he got all mavericky again and went off script to say that the fundamentals of the economy are still strong. Today is just another mavericky moment in a series of mavericky moment. There will be others and we will get to watch a campaign self-implode. Just saying.

The bailout will pay for itself!

Economics is messy!

Mission accomplished!

We will be greeted as capitalists!

Wall Street is the main front in the war on poverty.

The splurge is working.

I’m watching Rachel Maddow and Chris Matthews tear up McCain after Bush’s address. I guess Bush is really irrelevant.

Hey! I’m watching that as well.

Let’s see…

McCain = liar

McCain = razzle dazzle (change the subject away from the economy at all cost)

McCain = mixed messages

Now, will McCain show up for the debate?

Economic cleansing now!!!! The only bath I want to take!!!!!

Good question, pandora. Signs point to no, although there’s rumors that the deal is 98% done so perhaps McCain wants to take credit for it. I think the question is what happens now? Will Obama have the stage alone with Jim Lehrer?

I love the fact that debate team and Obama aren’t backing down. I’m having trouble seeing how McCain wins this point.

Still predicting that the Letterman video goes viral. Simply because it’s a lie everyone understands.

Pornstache-

1) Any firm that wants a bailout has to tie equity interest in their firm to the deal

2) Congressional oversight (though I would also be OK with a bi/non partisan board of finance and economics academics with no financial interest in the firms) to oversee (but not necessarily limit) compensation of management and to comment on their risk management policies

3) Accountability and public reporting for each and every cent spent by the Treasury Department

4) Congressional approval for any amount allotted in excess of $700bln

5) Immediate change to reporting requirements on all off balance sheet transactions/entities (as they were why there was no transparency allowing the markets to try to assess the leverage on these firms balance sheets)

These are steps that will protect taxpayers and ensure transparency. After the billions of dollars missing in Iraq, the fact that a former CEO of one of these firms would be in charge of this program with no oversight I believe that I have a right as a taxpayer to expect oversight and to not have this become a scam. What Paulson is asking for is insane.

These firms are 100% responsible for the leverage they put behind these derivatives. They have no right to a handout. We are not yet a Centralized Economy, $10,000 per family is a little more than I think should be spent without oversight or assurances that these firms repay the money provided by the treasury when their equities increase in a recovery of the economy.

All of the supposed ‘free-marketers’ clamoring for the bailout as-is are hypocrites. With a tie to equity and independent oversight this would be as close to a business transaction as possible given the circumstances. Handing $700bln to a unelected official personally and professionally tied to the beneficiaries with no oversight or potential upside to the government is not capitalist… it is not American… this is the stuff of the Putin’s and Burlusconi’s of the world…

And as far as not bailing the out? It would be a sharper short-term downturn. The longer term would recover more quickly without the bailout. Bailouts like this take the immediate pain of one sector of the economy and distribute it over a longer term over the rest of the economy. Just handing $700bln over to buy shit investments does not fix the structural problems in our economy, it will not reduce our energy problems, and will not figure out where resources need to be re-deployed for the economy to start growing… the market will… and it is going to take time. There are economists and finance professors opposed to this because it will extend the downturn and slow recovery. (Go to the Planet Money podcast if you want to learn a little about the situation before acting like you have a clue).

McCain will stop fundraising so he can lend his substantial economic wisdom to the fray.

Oh wait, he can’t fundraise, as he is accepting public money.

He will stop running ads so that he can work with his colleagues on the Hill (those on both sides of the aisle that he boasts about disagreeing with, for he is a maverick). Oh that’s right, the DNC and 527 groups are running ads for him.

The voters don’t need to see him in a debate. All they need to know is …

wait for it …

he was a POW!

The splurge is working.

If you thought of that I’m going to endow a fucking pulitzer prize for blog comments and award it to you.

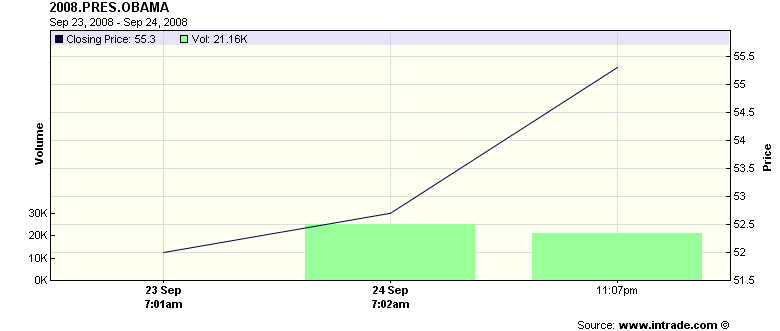

I just added that graph to support DD’s thesis. I can;t resize it though. Sorry.

1) Any firm that wants a bailout has to tie equity interest in their firm to the deal

So you want the government to own stock in private companies?

2) Congressional oversight (though I would also be OK with a bi/non partisan board of finance and economics academics with no financial interest in the firms) to oversee (but not necessarily limit) compensation of management and to comment on their risk management policies

Wasn’t there Congressional oversight all these years including Rep Frank and Sen Dodd?

3) Accountability and public reporting for each and every cent spent by the Treasury Department

Not an issue, that happens with any expenditure.

4) Congressional approval for any amount allotted in excess of $700bln

That requirement is a given, where else will the money come from?

5) Immediate change to reporting requirements on all off balance sheet transactions/entities (as they were why there was no transparency allowing the markets to try to assess the leverage on these firms balance sheets)

Why didn’t Sarbanes Oxley do this?

These are steps that will protect taxpayers and ensure transparency. After the billions of dollars missing in Iraq, the fact that a former CEO of one of these firms would be in charge of this program with no oversight I believe that I have a right as a taxpayer to expect oversight and to not have this become a scam. What Paulson is asking for is insane.

Paulson is offering action which can work.

These firms are 100% responsible for the leverage they put behind these derivatives. They have no right to a handout. We are not yet a Centralized Economy, $10,000 per family is a little more than I think should be spent without oversight or assurances that these firms repay the money provided by the treasury when their equities increase in a recovery of the economy.

Individuals are also at fault, did you forget them?

All of the supposed ‘free-marketers’ clamoring for the bailout as-is are hypocrites. With a tie to equity and independent oversight this would be as close to a business transaction as possible given the circumstances. Handing $700bln to a unelected official personally and professionally tied to the beneficiaries with no oversight or potential upside to the government is not capitalist… it is not American… this is the stuff of the Putin’s and Burlusconi’s of the world…

Wrong, stabilizing the markets is not a bailout.

And as far as not bailing the out? It would be a sharper short-term downturn. The longer term would recover more quickly without the bailout. Bailouts like this take the immediate pain of one sector of the economy and distribute it over a longer term over the rest of the economy. Just handing $700bln over to buy shit investments does not fix the structural problems in our economy, it will not reduce our energy problems, and will not figure out where resources need to be re-deployed for the economy to start growing… the market will… and it is going to take time. There are economists and finance professors opposed to this because it will extend the downturn and slow recovery. (Go to the Planet Money podcast if you want to learn a little about the situation before acting like you have a clue).

Recovery and transfer to another sector? Which sector is that?

Pornstache –

So you want the government to own stock in private companies?

Nope. Don’t believe in the government giving out free shit either. So your preference to the government being owed equity in the firms is to give it away? Good Conservative! Can’t believe you lost the primary!

Wasn’t there Congressional oversight all these years including Rep Frank and Sen Dodd?

Wow… I guess they were running congress all these years then? I am not a partisan hack like yourself, they are as to blame as the Republicans who were in control of congress until 2 years ago.

Not an issue, that happens with any expenditure.

Actually, no. This entity under Treasury will answer to no oversight and has no reporting requirements.

4) Congressional approval for any amount allotted in excess of $700bln

Wrong again. They are asking for a blank check. Current estimate is $700bln, was $500bln earlier this week. They are specifically asking for a blank check so they can handle any eventuality. May be a Trillion or more, Paulson will pull the strings – until the election – then it could be ANYONE. That scares me.

Why didn’t Sarbanes Oxley do this?

Nope. It was not a real reform package, it was window dressing. That was a pretty uniform reaction from the academics and shareholder activists at the time. It was bought and paid for by lawyers and lobbyists. Tons of reporting requirements, but little to bring information onto the balance sheets.

I know there are probably big words in the articles about all this but you might want to read something besides the Fox News ticker if you have an interest in knowing what is going on.

Individuals are also at fault, did you forget them?

Individuals have a contract with the bank. If they default the bank can have their house. Their credit is decimated. That is what their part of the contract entitled them to.

This is the free market you do not seem to understand. The banks made millions of these same contracts and did not manage risk appropriately. This allowed everyone to buy houses, which created a rather classic and predictable asset bubble. I work for an FI, I have a decent understanding of how the banks got where they are. They are not innocent victims of the evil people who lost their homes.

Recovery and transfer to another sector? Which sector is that?

I don’t know dipshit. Do you know ANYTHING about economics? You see, we have been employing hundreds of thousands of people in banks, building SUVs, building, houses,and other endeavors that now seem like bad ideas for the near future. Since there is no magic supply and demand fairy (at least as I understand it) people and firms will need to find other economic activities or be out of business/unemployed. Those people will need to work somewhere, and somebody will have an idea for a business. Lots of people will. Eventually the economy will stabilize and be healthier than it was before this crisis.

And eventually due to massive lobbying dollars and some other business model that desperately needs regulating that doesn’t (S+L Crisis, Accounting Crisis, Mortgage Crisis… what is next?) we will be here again. And great patriots of the free market like yourself will want to hand a blank check to the people who profited from taking crazy risks and got burned.

GIVING NEARLY A TRILLION DOLLARS TO PROP UP AN INDUSTRY IS NOT FREE MARKET. Read a book.

The saddest of sad parts here is that everyone will pow-wow over the weekend, they’ll make a few cosmetic changes, and then they’ll pass the goddamn thing.

To go along with the Director of Homeland Security we will then effectively have a Director of Homeland Economy, who will need a new, enormous bureaucracy (plenty of unemployed MBAs around right now), in order to deal with the never-ending crisis (we’ll find it necessary to prop up credit card issuers by next spring), because the crisis has to be never-ending….

…because what government agency ever goes out of business?

For the benefit of (maybe) avoiding or lessening the impact of one short-term recession to shake out the economy, our elected representatives are on the verge of signing away our birthright.

Bastards should be lined up against a wall and (oops, oh, wait, can’t say that–I criticized DelDem for saying that–hold my tongue–bite it ouch pain now i writ like dv oh shit it hurst must drink….

DelawareDem, all is forgiven: I’m ready to use my 2nd Amendment rights for the cause.

The splurge is my original writing. May I now call myself pseudo-pulitzer prize winning blogger LiberalGeek?

Steve – you crack me up.

It is highly specialized organized crime. People’s lack of understanding (and willingness to listen to anything a talking head says) got us here.

If you went to Pornstashe’s house and asked for handouts for the poor for an ambiguous charity with no charter I am sure he would not give you a cent. GWB asks and he is ready to hand my family’s $10,000 and everyone else’s in the country in a heartbeat.

Look at what we would have paid to have universal health care… would over a decade before it would hit $700 Billion. Better to bail out Wall Street than allow people the dignity of proper health care, huh?.

I am not for universal health care either, but it kills me to hear the same people who fight tooth and nail against ‘handouts’ fine with it when it is for banks instead of children.

Not Brian – Thanks for being here.

Actually, I wonder if healthcare wouldn’t actually be better, as it would lower the activation energy for a lot of the new businesses that will sprout from the scorched landscape of this economy.

So you want the government to own stock in private companies?

Nope. Don’t believe in the government giving out free shit either. So your preference to the government being owed equity in the firms is to give it away? Good Conservative! Can’t believe you lost the primary!

What is the government giving out for free? The potential to stabilize the market is better than a guaranteed free fall.

Wasn’t there Congressional oversight all these years including Rep Frank and Sen Dodd?

Wow… I guess they were running congress all these years then? I am not a partisan hack like yourself, they are as to blame as the Republicans who were in control of congress until 2 years ago.

Yes, but the misery clearly came to the surface recently and Dodd and Frank fought every attempt to reform Fannie and Freddie.

Not an issue, that happens with any expenditure.

Actually, no. This entity under Treasury will answer to no oversight and has no reporting requirements.

Wrong.

4) Congressional approval for any amount allotted in excess of $700bln

Wrong again. They are asking for a blank check. Current estimate is $700bln, was $500bln earlier this week. They are specifically asking for a blank check so they can handle any eventuality. May be a Trillion or more, Paulson will pull the strings – until the election – then it could be ANYONE. That scares me.

Yes, but where else will the money come from, of course Congress will have to approve the money no matter what the amount.

Why didn’t Sarbanes Oxley do this?

Nope. It was not a real reform package, it was window dressing. That was a pretty uniform reaction from the academics and shareholder activists at the time. It was bought and paid for by lawyers and lobbyists. Tons of reporting requirements, but little to bring information onto the balance sheets.

I know there are probably big words in the articles about all this but you might want to read something besides the Fox News ticker if you have an interest in knowing what is going on.

I don’t read Fox Ticker or watch the channel. So why was Sarbanes Oxley not done correctly?

Individuals are also at fault, did you forget them?

Individuals have a contract with the bank. If they default the bank can have their house. Their credit is decimated. That is what their part of the contract entitled them to.

This is the free market you do not seem to understand. The banks made millions of these same contracts and did not manage risk appropriately. This allowed everyone to buy houses, which created a rather classic and predictable asset bubble. I work for an FI, I have a decent understanding of how the banks got where they are. They are not innocent victims of the evil people who lost their homes.

Yes I understand the free market, I bought my first house with 18% interest rates. If the banks take all of these homes you will see a total implosion of all housing prices.

Recovery and transfer to another sector? Which sector is that?

I don’t know dipshit. Do you know ANYTHING about economics? You see, we have been employing hundreds of thousands of people in banks, building SUVs, building, houses,and other endeavors that now seem like bad ideas for the near future. Since there is no magic supply and demand fairy (at least as I understand it) people and firms will need to find other economic activities or be out of business/unemployed. Those people will need to work somewhere, and somebody will have an idea for a business. Lots of people will. Eventually the economy will stabilize and be healthier than it was before this crisis.

And eventually due to massive lobbying dollars and some other business model that desperately needs regulating that doesn’t (S+L Crisis, Accounting Crisis, Mortgage Crisis… what is next?) we will be here again. And great patriots of the free market like yourself will want to hand a blank check to the people who profited from taking crazy risks and got burned.

I know I won this argument when you have to resort to profanity. The housing market tanked well over a year ago and I am curious where the ‘transfer’ in the economy will be and when is that going to happen?

GIVING NEARLY A TRILLION DOLLARS TO PROP UP AN INDUSTRY IS NOT FREE MARKET. Read a book.

No one is propping up an industry, stabilizing a market structure is very important and critical to liquidity, solvency and economic growth.

You clearly have no understanding of simple economics.

I look forward to your next uninformed argument.

Agreed LG.

One of the bigger disadvantages for small businesses is costs like that…

To your point, we have choices where to spend our money as a nation. We generally make insanely poor choices because of the massive influence of special interests.

Is this $700bln the best place to put the money? And if it is, why the blank check and zero oversight?

This is a bonanza for lobbyists.

This is robbery.

I would rather fund health care, education, alternative energy, infrastructure, or other things that would be INVESTMENTS in the future.

Instead we have a gun to our head with people with financial interests talking about great depression and how we need to immediately approve the largest appropriation in the history of the country. It is highway robbery.

methinks that Mike is getting ready to retire…

Stash-

You are killing me. I can’t go line for line through it again, so I will say this: Talking points do not substitute for understanding. You can call me uninformed, I know from your answers I am far better informed than you are. Take a finance class.

OK – If I have no idea about economics, and I do not understand, explain to me structurally how this is not support for an industry? Explain to me how the concept of free market economics lends itself to this.

No one is propping up an industry, stabilizing a market structure is very important and critical to liquidity, solvency and economic growth.

Now, if your economic background were broader than listening to Rush Limbaugh in the afternoon (and we already established you watch Fox News) you might be able to explain to me how purchasing very specific securities from financial institutions are in no way a ‘propping up an industry’. EVEN THE PROPONENTS CALL IT A BAILOUT. THEY ARE SAVING THE BANKS.

If you understood economics you might see there are other solutions. Here is a fairly impractical one – there are ~$12 trillion in assets in mortgages in the US. The $700bln we are talking about would relieve ~5.8% of all mortgage debt in the US. If you actually applied the money to all mortgages in the US the banks would get a windfall of capital and homeowners would have 5.8% less principal on their loans, erasing one of the larger issues (the declining real estate values and resulting higher loan to value on foreclosures). This would allow order to return to the market. You could allocate the dollars by how each market is impacted, down to the zip code level… homeowners would benefit.

Impractical… but the other side of the same equation. In between paying down mortgages and buying up the resulting securities is a whole continuum of options with varying complexity efficiency, and accountability.

Giving the keys to the treasury to industry insiders to do with whatever they want (that REALLY is the plan right now – blank check – do anything one person decides) is the complete extreme reaction – and a banking lobbyist’s wet dream.

There are better options and there should be oversight, accountability, and transparency. If you do not agree, that is fine.

You are a politician, I would expect no less. That is how we got here in the first place.

Stash –

Ha! I just went to your web site… we have the same undergraduate degree from the same university… I must be stupid! Of course I went and got my MBA too, so I obviously have no idea what these banker types are up to…

The Johnny Holmes Red Baron gets swamped again.

Nice work NB!

nb just pwned someone…

damn our readers are smart

Not Brian, you are another uninformed and anonymous person who seems to know so much but in reality doesn’t know anything. You get a keyboard and type gibberish and assume Random House will publish it.

You use profanity when you know you have lost the argument. You say I watch and listen to FOX when I don’t. You have no logic and no case to be made.

You have no clue now about any of this matter. It is humorous to hear an anonymous hack who spouts economic theory as if he were Adam Smith. So, you are smarter than the Fed Chief and the Secretary of the Treasury? I doubt it.

This plan is going to happen despite your proclaimed brilliance to the contrary. All the complainers Pelosi , Dodd, Frank, Reid etc will vote for it en masse including Obama.

Come back when you have some semblance of credibility on an issue. If and when you get some real knowledge use your real name if you have the courage to do so. You and I know you never will.

Wow, NB, you must be exhausted! Thanks for taking up the charge. Very well done.

Now Protack really lost the argument. That last comment of his was just… well… silly.

Shorter Mike Protack – I won that argument because I say so!

Come on now, NB!!! You know that MBA is as worthless as a used piece of tp!

…..oh wait, that’s my M.E. sorry….

Proper beatdown! And Protack should be embarrassed by his flippant remarks in comment 32, which were shameful and nothing more than personal attacks without an iota of substance.

Watch it, VC. Mike will sue you…

Or threaten to…

Well, you don’t want to wake up with a dead wireless router in your bed, do you?

LOL!

Like in the Jerky Boys tapes?

“Ohes my eyes…they’re going craaazy! I’m gonna sue you for punitive damages!!!”

McCain’s next stunt will be cancelling the election in November.

You know it.

Yup.

Nah, why would Bush hand it to him after raising all that cash for the old man? It will be like Borat said ‘Emperor Bush’…

But in all seriousness, I do apologize if it got personal, but I am highly offended by the way that this whole issue has been handled by the government. This stuff gets me very angry because it will have a serious impact on our nation and was completely preventable. I find people’s willingness to march along with this laughable. This may have been the best action at this time, but there were other options available earlier, our range of options have dwindled because no one wanted to pay the piper.

I truly believe in a free market system. A free market does not function properly when the incentives are perverted. There were quite a few measures that the impacted banks could have taken to firm up their balance sheets including suspending dividends, putting aside loss reserves, and selling some the mortgage derivatives when they had a higher value. This did not happen over night. Several banks largely exited the market for these derivatives in order to avoid the crash (notably JP Morgan). Others continued to ignore all of the warning signs. They doubled down to avoid impacting their stock prices and now we are at this juncture. They should not get to keep the equity they built with the profits and leave taxpayers with the bill. It encourages this behavior in the future.

The bailout will be $2500 per person in the US (not including over $100Bln in other bailouts not including Freddie/Fannie) . This additional debt will also hurt the currency which means marginally higher lending rates in the long term and marginally higher cost on all imports. This will be a long-term drag on the economy – the trade off is that we will (hopefully) avoid an acute damaging shock to the banking system. That remains to be seen. Either way, our economy has been driven by trillions of dollars debt, that money will not be returning anytime soon. The economy is going to contract. We are in for a bad time either way.

I have nothing against Wall Street, it is the heart of the economy. But not paring off the weak banks for their excess is corporate socialism.

And Mike – Democrats AND Republicans supported the accountability I talked about originally. Though I am still not happy with the bailout I am much happier that it looks like there will not be a blank check to be spent by a former CEO of Goldman Sachs with no oversight. No matter what you want to argue with me, I can not see how a rational person can see that as the only solution (unless they own a large chunk of a bank).

You have nothing to apologize for, NB.