Why It’s Not Over, Part II

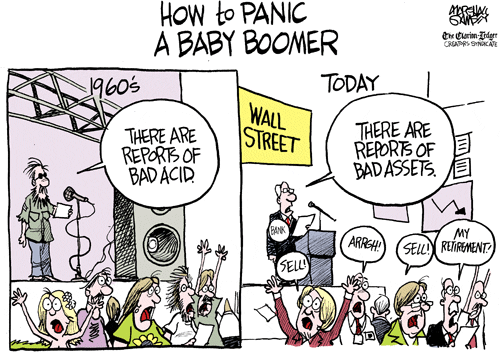

OK, this is just funny and we need a breather, but no one with any management skills at all tries to quell a real crisis this way.

More seriously, if I were a Nobel Prize winning economist this is what I would have to say about the Paulson business. As they say, read the whole thing:

The administration attempts to assure us that they will protect the American people by insisting on buying the mortgages at the lowest price at auction. Evidently, Paulson didn’t learn the lessons of the information asymmetry that played such a large role in getting us into this mess. The banks will pass on their lousiest mortgages. Paulson may try to assure us that we will hire the best and brightest of Wall Street to make sure that this doesn’t happen. (Wall Street firms are already licking their lips at the prospect of a new source of revenues: fees from the US Treasury.) But even Wall Street’s best and brightest do not exactly have a credible record in asset valuation; if they had done better, we wouldn’t be where we are. And that assumes that they are really working for the American people, not their long-term employers in financial markets. Even if they do use some fancy mathematical model to value different mortgages, those in Wall Street have long made money by gaming against these models. We will then wind up not with the absolutely lousiest mortgages, but with those in which Treasury’s models most underpriced risk. Either way, we the taxpayers lose, and Wall Street gains.

If we design the right bailout, it won’t lead to an increase in our long-term debt–we might even make a profit. But if we implement the wrong strategy, there is a serious risk that our national debt–already overburdened from a failed war and eight years of fiscal profligacy–will soar, and future living standards will be compromised. The president seemed to think that his new shell game will arrest the decline in house prices, and we won’t be faced holding a lot of bad mortgages. I hope he’s right, but I wouldn’t count on it: it’s not what most housing experts say. The president’s economic credentials are hardly stellar. Our national debt has already climbed from $5.7 trillion to over $9 trillion in eight years, and the deficits for 2008 and 2009–not including the bailouts–are expected to reach new heights. There is no such thing as a free war–and no such thing as a free bailout. The bill will be paid, in one way or another.

Tags: Bush's Fubar Economy

Stiglitz is discussing problems with the original Paulson proposal. Many of his ideas were incorporated into the House bill that went down in defeat on Monday…

I think our best bet is some kind of interim deal, $150M to get us through until the new president takes over. That means the next president will determine the direction of our economy. I don’t think anyone trust Bush, Paulson or Bernanke.

U.I.

You are so right! These are the last people who should be trusted with the future of America. And I don’t know if everything financial is going to seize up if we don’t do something. Perhaps the prudent thing is to do a little and try to limp along for the next 100+ days. In the overall scheme of history that isn’t very long. Then the grown-ups can take a shot of fixing this mess.

Somebody said that if Shakespeare were writing today the line would have been “first, kill all the bankers”.

Stiglitz also talks about revisions to the bankruptcy laws as well as real support to homeowners as part of the deal. These things were quite missing from the current package — either not included on purpose (bankruptcy) or toothless (working to stave off foreclosures in the portfolio we already insure). Plus Sitglitz calls for a transaction tax to pay for the bailouts we’ve already done.