The Aughts Were A Lost Decade

As you probably expected an analysis of the decade from 2000-2009 (which I’m calling the Bubble Decade) shows that it was the worst decade for Americans since the 1930s. It seems appropriate for the decade began with repealing the Depression era Glass-Steagall Act and ended with the Great Recession.

The past decade was the worst for the U.S. economy in modern times, a sharp reversal from a long period of prosperity that is leading economists and policymakers to fundamentally rethink the underpinnings of the nation’s growth.

It was, according to a wide range of data, a lost decade for American workers. The decade began in a moment of triumphalism — there was a current of thought among economists in 1999 that recessions were a thing of the past. By the end, there were two, bookends to a debt-driven expansion that was neither robust nor sustainable.

There has been zero net job creation since December 1999. No previous decade going back to the 1940s had job growth of less than 20 percent. Economic output rose at its slowest rate of any decade since the 1930s as well.

Middle-income households made less in 2008, when adjusted for inflation, than they did in 1999 — and the number is sure to have declined further during a difficult 2009. The Aughts were the first decade of falling median incomes since figures were first compiled in the 1960s.

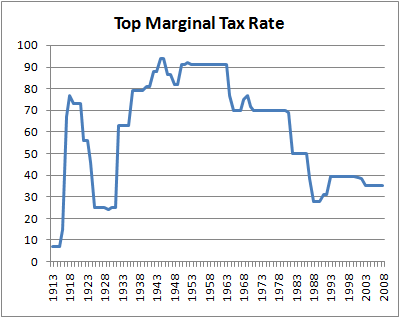

Anyone else notice how much stronger job growth was when we had a much more progressive tax system and strong unions?

Tags: Bush's Fubar Economy, Economy

One of the (multiple) reasons why we got our Great Recession is that middle class households thought that they could borrow to compensate for the lack of growth in incomes. But one of the great things about that graph is that it is pretty clear that tax cuts don’t have a damn thing to do with job creation or wealth building — except for the few people that got a tax cut worth having.

What was Bush’s mantra after 9/11,

“We’ll get Osama dead or alive.”“Spend, spend, spend.”But Cassandra, people borrowed because they believed they were ENTITLED to a growth in income. if they grew up in a house with a set of bunkbeds and a color tv, they thought their kids were entitled to HDTV and a Wii in every bedroom. What gave them that impression?

http://pewsocialtrends.org/pubs/706/middle-class-poll

relative col

Brooke, I think that you are right that people thought that more materialism than their parents is one way that people thought that they could show that they were doing better. But I also think that if you were to look at the productivity of American workers and the profitability of American firms during the same period, you’d find that Americans actually earned some of that growth in income. Instead, all of those bennies went to 1) shareholders and 2) increased insurance costs.

Well, I’m of two minds about “increased productivity” much of which is due to outsourcing and technical innovation for which the average worker can hardly claim credit. I think the average family has done pretty much exactly what the average corporation has done… expend their resources on shallow short term goodies without much interest in the larger picture, and then been surprised when the infrastructure of our culture collapsed about our ears.

Hoping for better, in the days to come. But if people weren’t willing, for example, to sell out the environment for bigger houses and the labor pool for cheaper goodies, the corporate world wouldn’t have been as able to do it, either.

One of the reasons we have a recession:

When a government is dependent upon bankers for money, they and not the leadership of the government contol the situation. Money has no motherland, financiers are without patriotism without decency, their sole object is gain. Napoleon 1815.

Trillions for Wall street? If Obama was the socialist, as the right would like us to believe, why wouldnt he just give every american $1million bucks! We would have spent that money on paying off our homes, and maybe even saving some for a rainy day. It slays me when the right refer to him as a socialist, a commie, this guy is an arch capitalist.

Political language is designed to make lies sound truthful, and murder respectable and give an appearance of solidity to pure wind. Orwell.

Chomsky wrote on Jan 2009, “A superpower of near demonic dimensions”. The masses are duped by consumerism and mind numbing entertainment. Is that not America today?

The stats as calculated and published by the BLS are based on labor hours done by workers in the US. And I know few people who can officially get away with just a 40 hour week anymore. Plenty of consulting businesses base their proposed labor rates on an assumption that labor is paid for 40 hours of work, but they’ll be required to work 45 or 50 hours on said project.

As for household income, this is from your previous link. You can see that overall incomes did not increase much over the last decade — certainly not as much as the profitability of alot of those businesses people worked at.

A progressive tax system nor unions have any positive effect on job growth.

When the federal income tax was enacted in 1913, the top rate was just 7 percent. By the end of World War I, rates had been greatly increased at all income levels, with the top rate jacked up to 77 percent (for income over $1 million). The decade of the 1920s had started with very high tax rates and an economic recession. Tax rates were massively increased in 1917 at all income levels. Rates were increased again in 1918. Real GNP fell in 1919, 1920, and 1921 with a total three-year fall of 16 percent.

After five years of very high tax rates, rates were cut sharply under the Revenue Acts of 1921, 1924, and 1926. The combined top marginal normal and surtax rate fell from 73 percent to 58 percent in 1922, and then to 50 percent in 1923 (income over $200,000). In 1924, the top tax rate fell to 46 percent (income over $500,000). The top rate was just 25 percent (income over $100,000) from 1925 to 1928, and then fell to 24 percent in 1929.

The rising tide of strong economic growth lifted all boats. At the top end, total income grew as a result of many more people becoming prosperous, rather than a fixed number of high earners getting greatly richer. For example, between 1922 and 1928, the average income reported on tax returns of those earning more than $100,000 increased 15 percent, but the number of taxpayers in that group almost quadrupled. During the same period, the number of taxpayers earning between $10,000 and $100,000 increased 84 percent, while the number reporting income of less than $10,000 fell

Your charts and graphs are showing the long term effect of the Federal Reserve Banking system and Keynesian economics.

LOL John Galt. I’m surprised you didn’t throw in the Arch Duke Ferdinand.

John Galt probably thought he was in some Ayn Rand sound-alike contest there. All rant and no substance.

Anyway — Tommywonk weighs in on this topic, highlighting the negative growth in the private sector over this period.

Cassandra,

You either didn’t read my post, or you don’t understand it.

Unstable Isotope made the following conclusion:

“Anyone else notice how much stronger job growth was when we had a much more progressive tax system and strong unions?”

I showed just the opposite happened between the years 1913 and 1929.

(Please read my post again). Tommywonk only address the years 2000-2009 and has nothing to do with my post.

I know you and Nimrod hate Bush, I do to. But twisting the facts and ignoring the past serves no one.

Oh I read your post alright, and pretty much gave it the attention it deserved. You can see just from the charts that UI posted that there is evidence that there was stronger jobs growth during the post war period when union workers were about 30% or so of the labor force and taxes were certainly more progressive.

So that means that you are the one here twisting the facts and ignoring the past. UI posted on real data here, and you just want us to buy some fiction you just today created.

And I posted Tommywonk’s thoughts on UI’s post for the information of everyone reading this post, which certainly is not just you, John Galt. And aren’t you supposed to be withholding your brilliance from the world until Barack Obama is out of office or something? Do us a favor, why doncha?

Also for Brooke and others on real wages in relationship to productivity gains throughout the decade, the NYTimes had a great article on this in 2006 with excellent charts.

Oh my numbers are correct, please check them.

As for the increase in labor in the WWII post war years, it had more to do more with the fact that most of the industrialized nations had their manufacturing base destroyed (England,Germany,Japan,France).

The U.S was able to supply the world with all the cars,appliances,and other goods that the world needed.

LOL, Galt, and what did the bubble growth during the Roaring 20’s lead to?

A progressive tax system nor unions have any positive effect on job growth.

Progressive tax and unions aren’t supposed to create job growth. We have plenty of other policies for that. Progressive tax and unions are intended to make sure more workers share in the prosperity they work to create.

Exactly anon. During the 2000s, corporations earned record profits, got rid of American workers and the CEOs rewarded themselves handsomely. The corporations didn’t share their profits with the workers.

Also, the way I read the chart, the economic policies that go along with the low taxation tend to lead to bubbles. The tax rates right before the Great Depression were very similar to the ones today. Interesting.

anon: Progressive tax and unions aren’t supposed to create job growth. We have plenty of other policies for that.

Really? Could we maybe get someone to put those in play then? In case anyone hasn’t noticed we have record unemployment in the country with the “experts” saying 2010 isn’t going to be much better. If we already have policies to create job growth I guess we aren’t using them????

The corporations didn’t share their profits with the workers.

Not to put too fine a point on it, but it’s not “their” profits. Unions are intended to give workers more power to negotiate how to divide up the earnings (and the losses). Progressive income taxes are an acknowledgment that high-income earners depend on the rest of society to earn that high income.

Could we maybe get someone to put those in play then?

Some of the policies are in place. But job creation isn’t a faucet that you can turn on and off instantly. It took time for Bush to destroy jobs, income, and wealth for the middle class. It will take time to recover.

I would never argue that the American worker isn’t screwed… by anyone with a dime and 15 minutes. My point is, no one BEHAVES like people who will be screwed, soon. That’s part of the problem. Look at our savings rates. http://research.stlouisfed.org/publications/review/07/11/Guidolin.pdf

Watching the wealth in our economy be redistributed upwards is my very least favorite thing about seeing Republicans elected. More than their assault on civil liberties, even. But if the electorate all behaves like Republicans when they have the chance to, justice will never prevail for long.

You can’t tamper with the same old broken tax system. Bush just made it more complicated and Obama is making it even worse. Dump it. It punishes savings, local manufacturing, and imposes an unreasonable compliance burden. Bush’s biggest mistake was not pushing forward on tax simplification and instead going for social security reform.

Next, it would help if we had an American trade policy. I am opposed to protectionism, but I do not believe that favoring imports by giving them better tax benefits than domestic production, allowing them to have no labor and evironmental levy, and giving tax credits to move from America is not in the best interest of the working people.

We also can not keep giving breaks for speculation and punish labor.