A Big Picture Look At the Stimulus One Year On

And it is — on the terms it was passed — a definite success.

David Leonhart wrote this must read article at the NYT on Tuesday, that starts like this:

Imagine if, one year ago, Congress had passed a stimulus bill that really worked.

Let’s say this bill had started spending money within a matter of weeks and had rapidly helped the economy. Let’s also imagine it was large enough to have had a huge impact on jobs — employing something like two million people who would otherwise be unemployed right now.

If that had happened, what would the economy look like today?

Well, it would look almost exactly as it does now. Because those nice descriptions of the stimulus that I just gave aren’t hypothetical. They are descriptions of the actual bill.

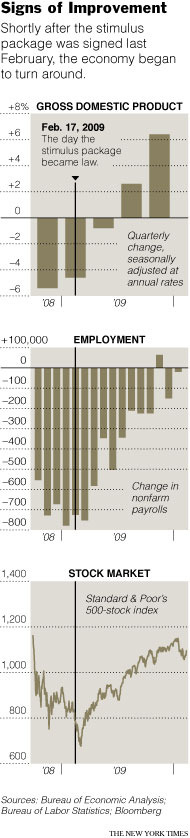

Leonhardt then goes on to survey the assessments of some of the independent economic research firms (they find that 1.6 million to 1.8 million jobs were added so far and that its ultimate impact will be an addition of roughly 2.5 million jobs. But there’s more — there’s graphs:

These are real signs of real improvement — certainly improved from this time last year when we were rapidly descending into the worst recession since WWII. It is not enough improvement, and that is largely a consequence of not asking for and not passing a large enough stimulus package. And employment is pretty much always the last thing to recover. The last one ended in November 2001 and unemployment kept rising until June 2003 hitting 6.3%. This economy is still delveraging and credit is still tight — meaning that cash for growth will be slow in coming.

But all that argues for is more stimulus spending — we still have massive infrastructure needs — and it argues for better PR for the current program. People are probably driving by ARRA signs all over their states and not getting that these are all stimulus projects.

Thanks for saving us from a 1930’s style great depression Mr Obama. What have you done for me lately?

Bad news is always “unexpected” in the age of obama.

45 mins ago WASHINGTON (Reuters) – The number of U.S. workers filing new applications for unemployment insurance unexpectedly surged last week, while producer prices increased sharply in January, raising potential hurdles for the economic recovery.

I don’t know…only 4000 homes saved from foreclosure. The rest…fuggetabuttit…they lost their jobs too since then, so I guess no use working with them. C’mon! Window dressers seem to remain gainfully employed.

Romeo: The “unexpectedly” refers to economic analysts, who make a living being wrong.

And the claims, as considered on Wall Street, rose in that week due to pent up claims from the prior week delayed by East Coast storms. Still, the absolute level remans well above healthy because the private sector is not hiring. Explain to me how that is the government’s fault?

And the day after Producer Prices rose and raised worries about inflation, as you note, consumer prices barely budged, dousing fears that inflation would hamper recovery.

So light a candle …

YAY MORE JOB LOSSES. because when americans loose, the republicans win.