On Deficits and Debts; or Don’t Believe the Entitlements Hype

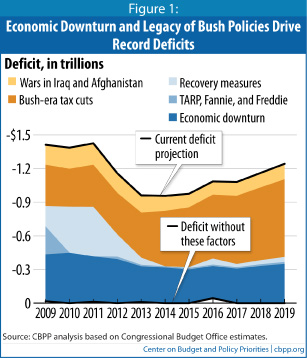

The Center for Budget and Policy Priorities continues its yeoman work on documenting where the federal Government’s deficits AND Debts come from. Even though most of the readers here likely get this story, it has yet to make much of a dent in the media narrative, which continues to flog the business about entitlement spending being the thing that is running our fiscal futures off of the rails. They released this analysis and accompanying chart of where our deficits continue to be derived from:

Stop and take a good look at that chart. Because this tells you in no uncertain terms that the major drivers of current *deficits* (debt discussion coming up) are — Bush-era (now also Obama-era) tax cuts and wars in Iraq and Afghanistan are the biggest drivers of our current deficit problems. The usefulness of this chart is being able to point out in no uncertain terms that ending or even changing Social Security or Medicare does noting to change the genuine drivers of the current deficits. Take another good look at this chart. Congressional Republicans (and some of their enabling Democrats) are looking not just to extend the Bush tax cuts, but to add more. And what will happen to the deficit spending chart above? There will be *greater* deficits, because not even changing entitlement spending (which does not now contribute to deficit spending) is going to decrease the magnitude of the hole in the budget due to tax cuts.

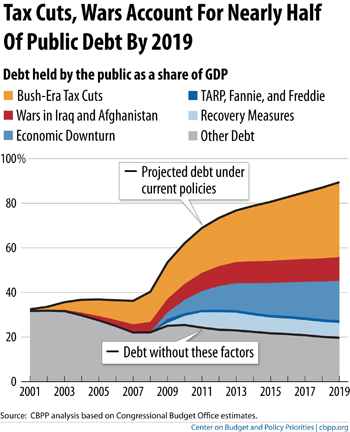

As for the Federal debt, the CBPP analyzed the drivers of that and also provide a similar chart:

Key point from the analysis:

“simply letting the Bush tax cuts expire on schedule (or paying for any portions that policymakers decide to extend) would stabilize the debt-to-GDP ratio for the next decade. While we’d have to do much more to keep the debt stable over the longer run, that would be a huge accomplishment.”

So that the real low-hanging fruit in trying to get our long-term debt under control is actually letting the tax cuts simply expire. The second-best low-hanging fruit is to get the economy really moving again, so that citizens and businesses can actually pay their taxes, meaning that Job Creation of some kind is the order of the day as a debt-reduction measure.

It *is* too much to expect, I know, but when the debate is largely numbers-based, it can’t be too hard for our media (AND our Democrats) to seriously challenge the idea that Social Security and Medicare (and Medicaid) are the real drivers of our financial problems. All three have their long-term stability problems, but the numbers tell a very different story. A story that ought to be told instead of just letting the usual suspects whinge on about the crisis of entitlement spending. Because the real crisis is letting people with agendas against Social Security and Medicare suck all of the air out of the room working at deflecting the conversation away from the real issues here. Time for that to stop — and when you see or hear media-types brainlessly blathering away about the “crisis in Social Security and Medicare” driving our long term deficit and debt issues, smack them back with data. Real data.

Tags: Deficit, Deficit Peacocks, National Debt, Republican Bamboozlement

The easiest way to fix most of the budget problems are quite simple, we just need people with enough political will to do it.

If you were to let ALL the tax cuts expire along with all corporate welfare and then not only tax dividends and capital gains at regular income rates but charge social security and Medicare on them (as the rest of us pay on our income) the deficit would most likely be paid down in no time and SS and Medicare would be saved forever.

Lets have the CBO do a look-see at that.

Just my opinion.

You are right — fixing the budget is pretty easy once you stop protecting all of the people who don’t need it who get rivers of taxpayer money.

Obama widened two wars and you bitch about money?

You ask for Wall Street accountability yet Obama has let the banks get bigger and bigger with no scrutiny.

You deny the trust funds are broke?

Talk about stupid.

Stupid would be:

1. Not noticing that this post is not about Wall Street accountability.

2. Not even being able to read a simple graph.

So thanks for playing.