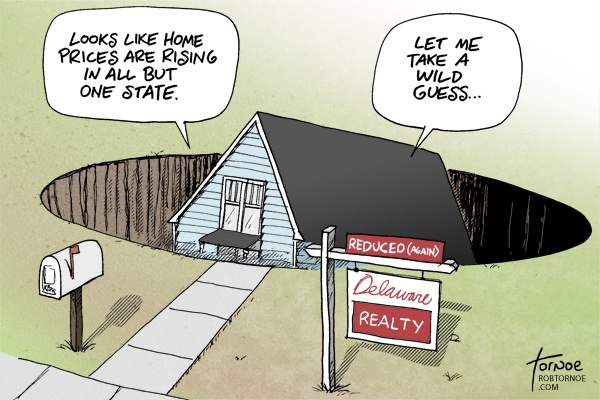

Delaware still struggling to leave the recession behind

According to a report by the Data firm CoreLogic, Delaware was the only state in the month of July where home prices declined, compared to the previous year. The ONLY state. There’s been some question about the numbers CoreLogic used to develop their assessment, but with Delaware’s small real estate market (in comparison to other states), foreclosures and short sales have a greater effect on the overall market, potentially leading to the decline in prices.

I blame George Bush.

CoreLogic uses the repeat sales model for determining housing prices. In a repeat sales model, two transactions for the same house are collected. These sale pairs are then fed into a regression model which is in a simple sense a period-to-period average of the price pair changes.

In a new home, there are no price pairs because, well because it’s a new house and there is but a single transaction. As the backlog of foreclosures has been eliminated there are fewer existing homes to be sold (at a foreclosure price). It is the foreclosure prices which has dragged down the sale prices, which is reflected in the data.

What is not reflected in the data are new home starts, sales, and prices. I happen to know that new home prices have increased, at least in Sussex County. There is nothing wrong with Corelogic’s model. It’s just that it doesn’t mean what Newsworks said it means (Delaware was the only state in the month of July where home prices declined, compared to the previous year.) Existing houses sale prices may have declined. New home prices have risen. Newsworks needs to examine source data a little better to understand the nuances.