Taxpayers Should Stop Subsidizing Low Wage Jobs

Bill Maher on Friday went to town on the hypocrisy of small government conservatives fighting efforts to increase minimum wages and to get corporations to pay a fair wage:

Just for the fast food industry alone, American taxpayers pay $7 billion in public assistance programs because fast food workers aren’t paid enough to feed their families:

- Medicaid and the Children’s Health Insurance Program, $3.9 billion per year

- Earned Income Tax Credit payments, $1.95 billion per year

- The Supplemental Nutrition Assistance Program, or food stamps, $1.04 billion per year

- Temporary Assistance for Needy Families, $82 million per year

This is a great topic, highlighted by one of our conservative commenters who has been extolling the virtues of low pay work that is subsidized by taxpayers (scroll down to the comments).

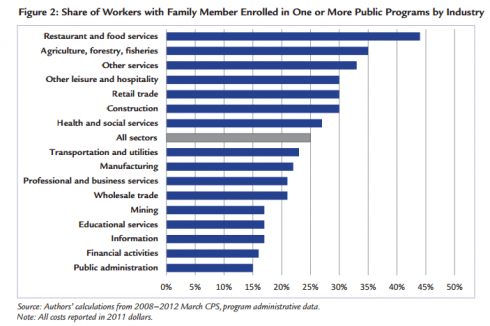

In Delaware, they estimate that taxpayers pay $228.4 million (pdf) in Medicaid, SCHIP, EITC, SNAP and TANF payments in order to bridge the gap for fast food workers who aren’t paid fairly or provided insurance. It’s a subsidy, though, a subsidy to these corporations who are immensely profitable and profitable because they can shift a pretty big cost of labor on to the local taxpayers. And it isn’t just the fast food industry, who seem to be the biggest offenders:

Taxpayers should not have to provide any supplemental funds to McDonalds or anyone else to support their workers. Nor can conservatives tell you that these jobs are meant for kids who need the pocket change and the job experience. In the fast food business more than 2/3 of the workers are over the age of 20 and most are the main providers for their families. Which, really, we know, right? No kids are working in McDonalds during the day — when they have school — and McDonalds certainly doesn’t close when the kids aren’t available.

I think I may have posted this some months ago, but California is looking to see if they can recover the money its taxpayers pay to subsidize the low wages paid by Walmarts in the state:

But, at long last and in a move gaining popularity around the nation, the State of California is attempting to say ‘enough’ to Wal-Mart and the other large retailers who are looking to the taxpayers to take on the responsibility for the company’s employees—a responsibility Wal-Mart has long refused to accept.

It’s about time.

Legislation is now making its way through the California legislature—with the support of consumer groups, unions and, interestingly, physicians—that would levy a fine of up to $6,000 on employers like Wal-Mart for every full-time employee that ends up on the state’s Medi-Cal program—the California incarnation of Medicaid.

The amount of the fine is no coincidence.

A report released last week by the Democratic staff of the U.S. House Committee on Education and the Workforce, estimates that the cost of Wal-Mart’s failure to adequately pay its employees could total about $5,815 per employee each and every year of employment.

There are small business advocate groups who are calling attention to this unfair subsidy, too:

Data published by the state of Massachusetts reveal that Walmart has 4,327 employees — approximately one-quarter of its workforce — enrolled in the state’s Medicaid program or one of two other publicly subsidized health insurance programs. Insuring these employees and their dependents costs taxpayers $14.6 million a year. Target has an even larger share — more than one-third of its Massachusetts workforce, or 2,610 people — enrolled.

States should absolutely be in the forefront of capturing these subsidies, especially from the profitable multi-nationals. If you are the Governor of a state trying to get these moneys back, the biggest selling point is that you get to reduce the growth of some of your biggest line items AND you are stopping the cost shifting in order to ensure that you can attract businesses who will pay a living wage. This ought to be a project for progressive Democrats next year here, too. But hey! We have a Congressional conference committee that is looking for a bargain, and recovering taxpayer subsidies from Walmart and Target and the low wage kings seems like just the thing.

Tags: Corporate Welfare, Fair Wages

…levy a fine of up to $6,000 on employers like Wal-Mart for every full-time employee that ends up on the state’s welfare….

That is a fantastic market-based solution that would certainly work here in Delaware and would no doubt get a lot of bipartisan support in the legislature.

That is only part of the Wal-Mart subsidy story. Wal-Mart and Sam’s Club have received tax breaks, loans, payments, etc. Why are we helping the richest family in America get advantages not available to competing small businesses?

That’s true, Tom. Many of these stores have gotten various tax breaks, loan guarantees, development grants from states and municipalities that they plan to locate in. These tax breaks are often in the form of sales tax forgiveness — meaning that the state or municipality is actually giving up revenue in order to help subsidize low wage workers for rich companies.

Jason330: “That is a fantastic market-based solution that would certainly work here in Delaware and would no doubt get a lot of bipartisan support in the legislature.”

“Market-based”, you say?

http://youtu.be/G2y8Sx4B2Sk

Your feedback is lacking, something… I don’t know…. Cogency ?

Ok, how about before the State of Delaware starts levying fines, they clean up their own mess?

Lots of State employees are limited to 29 hours a week so the State doesn’t have to give them benefits. These employees collect food stamps and go on Medicaid. I work with them. Out of 14 State employees in my division, 8 are limited to 29 hours per week.

The proceeds from the substandard pay waivers could pay for those state folks to go full time.

Why don’t these folks just get better paying jobs? Oh wait a minute they didn’t graduate high school or college…

Either that or all the decent manufacturing jobs left the country thanks to NAFTA and the pernicious effects of Shareholder Value Myth

I wonder what we could call such legislation? Oh, how ’bout the Single Mothers Unemployment Act?

Eligibility for welfare is based on more than just income; it’s also based on expenses and family size. A Walmart worker married to a policeman probably will not be eligible for welfare, where a Walmart worker just shacked up with a policeman might be, if the policeman doesn’t “officially” live there. A teenager with no kids, living with his parents, won’t be eligible.

What your suggestion would do would be to create an incentive not to hire unmarried mothers; a single mother working a lower-wage job is the person most likely to be eligible for welfare, so lower-wage employers would have strong financial reasons not to hire such people, and get rid of the ones already on the payroll.

Former DEDO director Judy Cherry had a policy that the Strategic Fund would not be used to subsidize jobs that did not pay a sustainable wage. We had a report from the Urban League, presented to the governor by then-Treasurer Jack Markell, that detailed what a “sustainable wage” meant in Wilmington, Dover, the counties, etc. She came under a lot of fire from elected officials who just wanted a jobs body count – even if it was a fast-food or warehouse job. This policy was pretty cutting edge at the time.

It was done away with almost immediately by incoming director Alan Levin.

Using taxpayer dollars to subsidize jobs that would need more subsidies from taxpayers (food stamps, housing, Medicaid, WIC, etc.) is folly.

Mrs Walling wrote:

We shouldn’t be using taxpayer dollars to subsidize any jobs, period.

@Lee Ann Walling – thanks for mentioning that. Our current approach to economic development is nothing more than a race to the bottom.

What your suggestion would do would be to create an incentive not to hire unmarried mothers; a single mother working a lower-wage job is the person most likely to be eligible for welfare, so lower-wage employers would have strong financial reasons not to hire such people, and get rid of the ones already on the payroll.

This is singularly moronic, given that you say later that we shouldn’t be subsidizing any jobs, period.

The point is that the jobs that the Walmarts and the food industry types provide don’t support families. Which is why those families also need taxpayer support. Most of these companies are making money hand over fist. There is no reason why they can’t pay their workers a living wage and stop using taxpayer money to make more money.

We are subsidizing the fast food industry with corn and soy subsidies. They provide cheap animal feed, HFCS used in sodas, and frying oils.

I wonder what we could call such legislation?

Ending Walmart Welfare is a pretty good name.

Cassandra wrote:

It wouldn’t be a subsidy, but a penalty to be avoided. We shouldn’t subsidize any jobs, whether low end or high end.

But, tell me: just what do you find “moronic” about it? The suggestion was that a company which pays wages low enough that some of its workers might qualify for welfare in some fashion would see a penalty for each worker who qualifies for welfare. Somehow, you believe that would force companies to pay higher wages; I have pointed out that, depending upon the employees’ circumstances, some would not qualify for welfare, and that companies would seek to employ only such people.

Companies base hiring decisions on the costs of the employee all the time. A few have decided not to employ anyone who smokes, because smokers cost more in health insurance and in lost time for cigarette breaks. Many — unofficially, of course — discriminate against the obese, something which is not illegal, due to increased health care costs.

Singularly moronic is accurate. He has no standing to discuss this topic.

Dana makes no sense. Companies like McDonald’s and Walmart rely on the very employees Dana sneers at. Without those people these companies wouldn’t survive, because people with options don’t want to work at Walmart, McDonald’s, etc. As a stay-at-home mom, when I go back to work it won’t be at any of these places.

@Dana “I have pointed out that, depending upon the employees’ circumstances, some would not qualify for welfare, and that companies would seek to employ only such people.”

I think this is a good point. So the obvious solution is to simply raise the minimum wage. Right?

I have pointed out that, depending upon the employees’ circumstances, some would not qualify for welfare, and that companies would seek to employ only such people.

This is the singularly moronic part. So now Walmart is going to do means testing for jobs that let the government means test those employees for food stamps. Right. This is just another way of saying that those jobs were meant for kids who just need pocket change. And that simply ignores what the job market — from both sides — looks like.

The government charging Walmart and others for the government services that we are providing to their employees is damned good business on the government’s part. If Walmart wants to avoid paying back the government, they can provide wages and benefits that get to a living wage.

‘We shouldn’t be using taxpayer dollars to subsidize any jobs, period.’

That’s what we do, and what is, in fact, part of the business plans of Walmart and McDonald’s, among others.

Hell, Walmart even shows employees how to apply for state and federal assistance. To the tune of about $10K per employee in government subsidies.

I’ll betcha that this new chicken plant being hailed as economic growth by Markell and Levin will also lead to additional state and federal subsidies for those earning less than a sustainable wage. Any comments, Governor?

BTW, minimum wage legislation, which passed the State Senate, remains buried in House Committee, courtesy of Speaker Pete, committee chair Bryon Short, and, yes, Gov. Markell.

This MUST be a focus of progressive energy come January.

@c “This is the singularly moronic part.”

How so? If you provide a severe penalty for hiring single mothers, but not for other people, guess what will happen? Isn’t it obvious?

However you fix this problem, you shouldn’t be creating more problems. That’s why the most simple solution (higher minimum wage) is the likely the best.

If you provide a severe penalty for hiring single mothers

This presumes that Dana’s “single mothers” is the right group that is affected by this. and you do not need to be a single mother to qualify for Medicaid or Food Stamps or housing vouchers.

I do agree that a higher minimum wage is the better solution — and that employers like Walmart shouldn’t manipulate work hours to deny benefits. But an effort to retrieve the loophole subsidy from the Walmarts would at least remove the ability of these retail outlets to increase their profits by shifting costs to local and state governments.

We also need to reform the culture to create cultural disincentives for increasing profits at the expense of local and state governments.

I think those reforms are coming, but it will be a slow process to unwind the mayhem created over the past 40 years.

Liberal Elite has the right idea. Raise the minimum wage.

Allen Harim foods (the new chicken plant) plans to renovate a brownfield site outside of Millsboro with $100 million investment. All 700 brand new, full time, year round, factory jobs will pay above minimum wage and include benefits.

Despite the naysayers, I see this as a good thing.

http://www.upcedarcreek.net/a-tale-of-two-tourism-strategies/

I wrote about one questionable “economic development investment” in the above post.

That is some good economic development. (I really like the blog too)

While I have no objection to the chicken plant (I don’t live in Millsboro) because Sussex County and chickens go hand in hand, I do think we could do better in creating jobs of greater value. The proximity of Sussex County to the Beltway, Baltimore, et al should be a strong selling point for technology and other jobs. After all, if one has broadband, it doesn’t matter where you live. There are many in the county that telecommute, with occasional forays into DC. There could be more and telecommuters do not strain transportation infrastructure since they work in their pjs. There is nothing wrong with more blue collar job opportunities, but a diversity of opportunities provides a path for growth and advancement as well as a hedge against market forces so that a community cannot overcome pickle plant closures for example.

Right now farmland is worth more for crops than houses because they need every spare inch to grow corn and soybeans for chickens. That means no room to try new crops such as barley to support our microbreweries, algae for renewable energy and pollution reduction, value-added crops for the biotech industry and the farm to table restaurant craze, etc. Farmers aren’t interested in being paid to set aside buffers for restoration, pollution reduction, etc., because they can’t spare the cropland. We’re a victim of our success in the poultry industry.

Here lies a fine example of government policy creating a worse situation than it was intended to alleviate, along with the countless unintended consequences that invariably accompany such shortsightedness.

More of the singularly moronic.

The government policy was meant to provide support to those who are in poverty. It is not meant to provide support to companies who intend for their employees to be in poverty. The problem is not in the policy but in the government’s lack of defense of its policy AND in it’s lack of interest in establishing livable wage standards. Now that there’s no money, legislators look at the pot of money they are paying out to support working people and rightly want that back.

Also, Market Based here is here under multiple names and that is against this site’s policy. I’m going to demonstrate how paying attention to your own interests works, and put an end to your privileges here. You can get them back by emailing me the name you will use to participate here.

That’s some mighty fine glibertarian jibber-jabber you’ve got there. It would be even greater if you didn’t confuse cause and effect, or at least allowed for the possibility that widespread deregulation, the off-shoring manufacturing and the pernicious myth that shareholders are the only constituents that matter had something to do with state subsidization of low-wage labor.

Oh well. You are more interested in being doctrinaire that being right. It is a pity. Don’t be to hard on yourself though. It happens.

Hell, Walmart even shows employees how to apply for state and federal assistance. To the tune of about $10K per employee in government subsidies.

And which former President can we thank for that, El Som?

That President would be the lawyer who challenged the definition of the word “is”, but couldn’t come up w/ a rock-solid welfare reform law.

The “reform” that Clinton sold us was supposed to transition welfare recipients to real work in real jobs that paid real money. Apparently the “reform” laws were poorly written, as corporations saw those same laws as a license to keep low wage workers at the bottom & screw both the employees and the taxpayers whenever possible. It’s no wonder the Rs voted for this shit.

BTW, where exactly is Walmart headquartered? Didn’t WJC once govern that cesspool of a state?