Even though the economy is improving, and thus tax revenues that states receive are rising and returning to pre-Second Great Depression levels, 16 states are still projected to run budget deficits in next year or two.

Those gaps range from lows of $17 million in Vermont and $34 million in Rhode Island to $4 billion in Washington State over the next two years and $2.2 billion in Wisconsin next year alone. The gaps come even as tax revenues are rebounding. The nonpartisan Rockefeller Institute reported on Thursday [pdf] that tax revenues rose in 41 states in the third quarter over the same period last year, led by a 5.9 percent increase in sales tax collections and a 4.3 percent rise in personal income taxes. The growth isn’t strong enough to make up for the increasing costs states must shoulder. Scott Pattison, the executive director of the National Association of State Budget Officials, said rising Medicaid and health care costs are to blame in many states.

Delaware had a $19.2 million deficit into Fiscal Year 2015 that was resolved in the budget passed in June 2014 (remember, states actually have to balance the budget, with revenue risers or spending cuts or both when there is a revenue deficit). This year?

The Delaware Economic and Financial Advisory Council (DEFAC) estimates the state will have nearly $2 million dollars more in 2016 revenue than it projected in September. The forecast also projects the state having nearly $10 million dollars more to work with in its fiscal 2016-spending plan. […]

DEFAC also projects a nearly $17 million dollar drop in revenue for the current fiscal year, but [state budget director Ann] Visalli says that is not an immediate concern. “We’ll have enough time to manage through that between now and the end of the year and we’re still projecting a positive cash carry forward,” said Visalli. “So, we’re OK.”

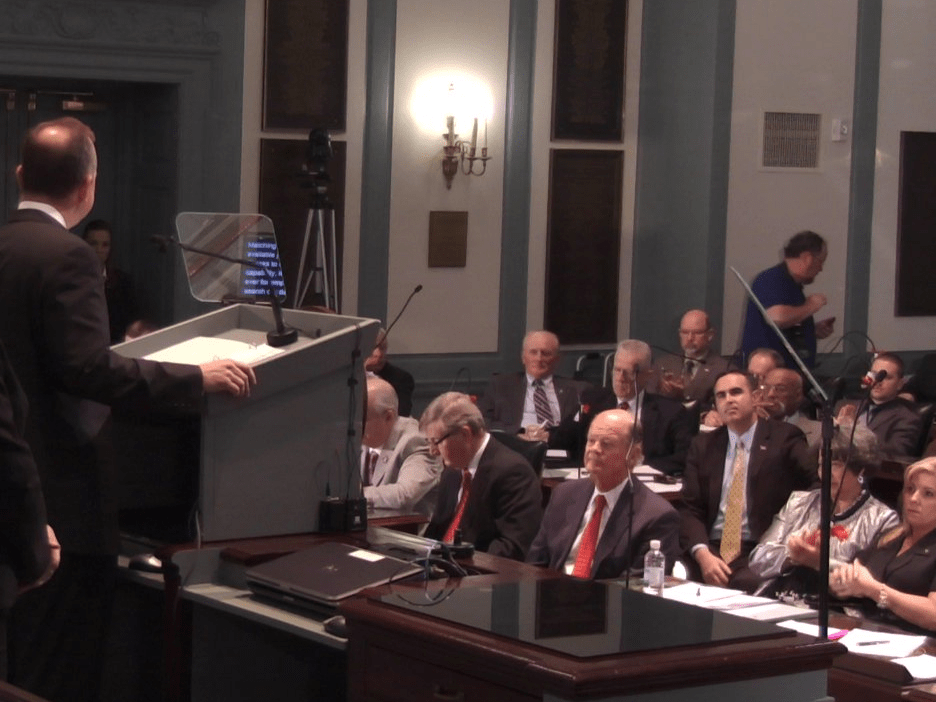

Monday’s estimate is the final DEFAC revenue projection before Gov. Jack Markell’s administration begins to craft its proposed budget. Markell presents that spending plan next month.

Boy is that confusing. Which is it? Are we $17 million down in revenue and thus do we have a $17 million deficit? Or do we have a $12 million surplus? Or is it both, and that is why Ann Visalli is not worried. Meaning, that yes, we are $17 million down in the expected and forecast revenue that state was to receive from tax payers, but the state has received $12 million in unexpected revenue/income/fees from other sources, and thus we are really only $5 million down.

Now, longtime readers will know my frustration with Delaware and its revenues. We have what is essentially a flat tax rate system for the middle and higher brackets of income. If one person has $60,000 in taxable income and another has $600,000 and another has $6 million, they all pay exactly the same tax rate. But we can never… NEVER!!!!!! … raise taxes on those at the higher levels, because, you know, they are job creators and it will hurt their fees fees. So we have to scrounge around every year, waiting desperately for every DEFAC forecast to come out with good news. We have to talk about raising regressive fees and taxes, like the gas taxes, which fall disproportionately on those who least can afford to pay more. We have to talk about deeper and deeper spending cuts.

And we have to resort to a Task Force to tell us what is wrong with our “revenue structure.”

State officials used Monday’s meeting of the Delaware Economic and Financial Advisory Council (DEFAC) to announce a task force is being formed to examine how the state‘s bottom line is built. State Finance Secretary Tom Cook says concerns that 56 percent of the revenue feeding Delaware’s General Fund come from static sources prompted the decision to form the panel.

“You’ve heard the statements where the state’s job rate, growth rate is out-pacing the nation, but in turn the revenues have not accelerated as fast. And so, this is a great way to look at that 56 percent of the revenue sources that are inelastic and to see what recommendations come up..”

House Minority whip Deborah Hudson (R-Fairthorne) says it’s the right time to delve into these issues. “I think its an excellent opportunity and I think you’re going to get the bold innovative ideas from the non-government members,” said Hudson. “And I think they’ll consider things such as changing the deal between the casinos and the state, maybe changing the escheat laws. Really just shaking the tree – all new ideas.”

It will be nice for the Task Force to come back with actual Revenue Ideas that will actually raise revenue (i.e. no suggestion of tax cuts), and it will be a great idea for the state not to rely on gambling income as static part of the revenue side of the budget, since gambling income has fallen some 30 percent since 2004. And that number will continue to drop as more and more states open up more and more competing facilities. What we should do is renegotiate our end of the deal that greatly reduces the amount the state receives from the racinos while forbidding any future future bailouts of them. We should also establish a progressive tax rate structure among all tax brackets, adding more to the top end.

But I suspect the task force will come back with proposals for a gas tax and a sales tax, both regressive taxes, and both unpopular, which will “force” the Governor to look to spending cuts to education and Medicaid. That’s the Delaware Way.