We already know that a provision to roll back the Dodd-Frank provision that forbid banks from booking their derivatives in the the parts of their business that is insured by taxpayers. They would have to keep them in the portions of their business where losses were borne entirely by the bank and their shareholders. Elizabeth Warren led what Bloomberg called The Great Swaps Rebellion during the Cromnibus negotiations. And John Carney was peeved:

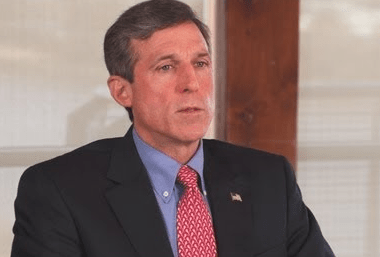

John Carney couldn’t understand why the vote was so close. The Delaware congressman, a Democratic member of the House Financial Services Committee, had been there when a reform to the Dodd-Frank “swaps push-out” passed—in a 55-6 landslide. He’d joined a veto-proof majority, 292-122, to back the reform in a House bill that was throttled by the Democratic Senate. The bank-friendly Democrat had not expected the reform’s quiet return, as a rider in the must-pass “Cromnibus” spending package, to kick off a revolt.

“This passed with nearly 300 votes,” said Carney on Thursday night, after the House had voted on the Cromnibus, and as legislators of both parties congratulated him or wished him Merry Christmas. “It would have been more than 300, like some of the other bills we’ve done, if there wasn’t this toxic description of what it might do. Unfortunately, the world we live in, the political world, is one of perception. I try to deal with the facts. Sometimes that’s at odds with the way we do work here, where you get these political narratives that take on a larger than life part of the discussion.”

Put it this way: Carney was not Ready for Warren.

(I really wanted to quote that last bit.) This entire article is Carney not being ready for Warren — or specifically not being ready for the kind of representation that looks out for taxpayer dollars, especially when being promised to people who don’t have a recent good track record of managing their own risk.

Thursday, Politico (sorry) notes that the “liberal” and “moderate” wings of the Democratic party are at some odds over this new state of affairs:

Liberal Massachusetts Rep. Mike Capuano incensed the moderates when he said if Democrats support rolling back Dodd-Frank regulations, “you might as well be a Republican.”

Capuano’s comments were so pointed he immediately offended the handful of Democrats who had voted with Republicans previously on the issue and still support it, the sources said. Capuano said in an interview that he stood by his remarks and he had not heard that any of his colleagues were upset. The bill was defeated by Democrats Wednesday.The moderate Democrats pushed back in the caucus meeting in exchanges described as “intense and emotional.”

They were angered because that same legislation had garnered support from more than 70 Democrats in the 113th Congress, but became a political landmine after Sen. Elizabeth Warren (D-Mass.) criticized the legislation as a Wall Street handout.

So really it looks as though Warren is making it tougher for the so-called moderates to hide their corporate ties and interests behind the label of “moderation”. And it is about time:

At the New Democrat meeting, Hoyer was on the receiving end of impassioned concerns by his moderate colleagues. Reps. Gerry Connolly (Va.), John Carney (Del.) and Jim Himes (Conn.) all voiced strong opinions, according to sources in the room.

The 40-member group expressed anger at the liberal faction for name calling and for dismissing their point of view outright. The lawmakers told Hoyer that any future Democratic majority would look more like them than the liberal faction of the caucus.

Maybe. But if Elizabeth Warren’s fight against this rollback is any indication, it is going to be really hard for these moderates to do the business of their corporate funders without making sure that they are seriously representing and making sure that government works for the people they ask to vote for them every 2 years. But these “moderates” also need to come to grips with how angry Americans still are that banks got away with damn near killing us all, then got extraordinary help from the government to survive. Lots of middle-class homeowners never got that kind of help and they were the front line of the crash. Too bad that John Carney doesn’t care about this or the people who are still suffering from the bad behavior of the banks he so furiously works for.