Last night, Oscar host Neil Patrick Harris noted that the gift bags that nominees and other special attendees and guests received had items in them that totaled over $100,000.00, and one of the items was a gift card for a Brinks security van to come pick the bearer up and to take him or her to safety once the Revolution comes.

Well, it is time for the Revolution to come. And by revolution, I do not mean the automatic beheadings of the wealthy by us were regular Americans (although that may be the next step if the wealthy prevent, in any way, what I am about to prescribe). No, by revolution, I mean adjusting the tax code such that this country and state can function once again. David Sirota calculates that, if we just tax the wealthy at the same relative rates as we tax the middle and lower classes, we would be able to raise hundreds of billions of dollars:

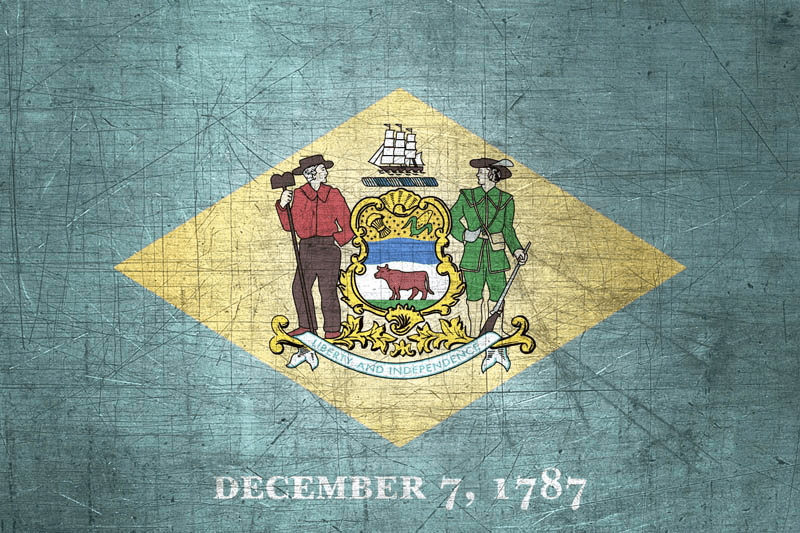

Roads are crumbling, bridges require repairs, schools need upgrades and public pension systems remain underfunded. How can states and cities find the money to address any of these problems? One way could be through their tax codes.

According to a new report, if the rich paid the same state and local tax rate as the middle class, states and cities would have hundreds of billions of dollars more a year in public revenue.

Last month, the nonpartisan Institute on Taxation and Economic Policy found that the poorest 20 percent of households pay on average more than twice the effective state and local tax rate (10.9 percent) as the richest 1 percent of taxpayers (5.4 percent).

Kavips recently had a post where he calculated what adding more progressive tax rate tiers to Delaware’s Flat Income Tax System for the wealthy would mean in terms of added revenue for Delaware. He reported that the average income for the top 1% of Delaware’s income earners and tax filers in 2012 was $863,734, and that there were 4,747 tax filers who constituted the top 1% in Delaware in 2012. That means that there are 2,373 tax filers in Delaware who made at least $863,734 in income in 2012. So Kavips did a little math (which I have fixed a little bit since half of 4,747 is not 2,424 but 2,373.5):

If the top .5% of Delaware tax filers all at least made $863,734 in a year, that would mean that that total minimum income they made in one year.. one year… was $2,050,072,649.00. Yes, that is 2 billion dollars. In one year. And a tax of 1% on that minimum level of income of the top .5% would raise $20,500,726.49.

20 million.

As Kavips says, that is

…[e]nough to fund all of Delaware’s casino losses for a full year or the average spent on Race To The Top per each of its 5 year cycle; or a one percent raise for all of Delaware’s state employees.

Kavips then examines what other states charge as its top rate, remembering that Delaware top income level is $60,000 and top income rate is 6%:

California charges 13.3%… It’s economy is booming btw.

Oregon charges 9.9%… Doing well too.

Minnesota at 8.95%… No harm there.

Iowa 8.98%… Those corn huskers are quite happy there.

New York 8.82%… Everyone “Hearts” NY.

Our neighbor, New Jersey? 8.97%….

Even Republican Scott Walker’s state, Wisconsin charges higher: 7.65%!!!

Here is the Kavipsian Progressive Tax Fairness Plan of 2015, which I demand the General Assembly enact forthwith!

Here is the recommended rate schedule that Delaware needs to implement.

Incomes over $400 billion @ 12 %

Incomes between $400 and $100 billion @ 11%

Incomes between $100 and $1 billion @ 10%

incomes between $1 billion and $400 million @ 9%

incomes between $400 million and $100 million @ 8 %

incomes between $100 million and 1 million. @ 7%

No change for incomes under $1 million… [6%]

It will be amazing how quickly our budget problems end, with no need to enact new and higher regressive taxes on the poor and middle class.