Tag: taxes

Guest Post: Delaware’s Government Channels Its Inner Trump

Secretary of Finance Tom Cook’s recent op-ed epitomizes the strategy of hiding things in plain sight. Secretary Cook and Governor Jack Markell’s revenue review panel has concealed among its recommendations for making Delaware tax revenues more “elastic” an ideologically driven agenda of tax cuts for the wealthy and out-of-state corporations at the expense of our state’s middle class, senior citizens and local business owners. That our governor could sanction such recommendations is a prime example of how politics in Delaware has been hollowed out in favor of profit taking.

Let’s first notice that in a era of declining revenues and increasingly challenging budgets to balance Governor Markell’s instructions forbade raising new revenue: “if a recommendation was made that could be expected to generate additional revenue for the state, then a corresponding revenue reduction would also be proposed to offset it.” This means (in English) that Cook’s panel was not interested in providing more money to balance our budget, but in changing who pays the bills.

Tax Day Reading

It’s the obligatory Tax Day thread — but while I’m going to post some items related to paying taxes, I also want to note that today is Jackie Robinson Day, which is a happier thing to consider than Tax Day. I hope that all of you are done with that task. Delaware and Wilmington taxes are due by the 30th, so there is some breathing room.

Boehner: If my taxes go up, so will yours.

House Speaker John Boehner today rejected a proposal from former NRCC head Rep. Tom Cole (R-OK) to extend existing tax cuts for middle class Americans, primarily because Boehner (and other wealthy Americans whose incomes have been going up while everyone else’s has been going down) doesn’t get a piece of the tax cut action.

Prove It!

Mitt “Because I said so” Romney: The fascination with taxes I’ve paid I find to be very small-minded compared to the broad issues we face. But I did go back and look at my taxes and over the past ten years, I never paid less than 13 percent. I think the most recent year is […]

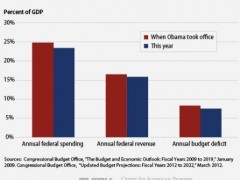

Spending, Taxes, Deficit: Lower Now Than Inauguration Day

The facts, as laid out by Think Progress. Reality, as we all know, has a liberal bias.

Stephen King: Tax Me, for F@%&’s Sake!

I’ve been reading a lot of Stephen King this year, I guess I needed some fun reading. But his essay, Tax Me, for F@%&’s Sake!, is just fan-freaking-tastic. A must read.

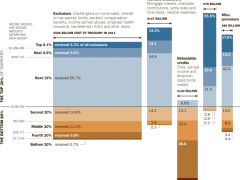

Who Gains Most from Tax Breaks

David Leonhardt and the NYT have created another outstanding graphic trying to explain the landscape of current tax policy. This one shows what taxpayers get the greatest benefit from the various tax breaks currently in the code by income group. Click on the image for the larger graphic or click here if that doesn’t work. This graphic is part of a great explainer that lays out what happens and the stakes for the coming end of lots of government benefits in January 2014.

Dear Pennsylvania

Dear Pennsylvania: Okay, we toyed with filing a tax extension, you know to be like Mitt. However, better judgement took over and we electronically filed over the weekend. But Pennsylvania, did you have to text us at 5:22 AM that you “received” our taxes? Much Thanks, Mr. and Mrs. Nemski

Draft Your Own Tax Fairness Plan

The folks at Splitwise (an expense sharing application) put up a model that will let you change tax brackets and deductions in order to work out a fairer tax plan. Part of what is interesting about this is that you can save your plan and submit it to the community for a vote. Splitwise will submit the top voted plans to Congress.

‘Buffett Rule’ to Lose in Senate Today

The ‘Buffett Rule’ which would increase the tax rate for millionaires will come up to a vote in the Senate today and lose.

Progressive Taxation Makes Us Happier

Turns out taxing the rich to help make a better society is not only a good thing, but it makes us happier.

Israel Leads – Who Will Follow?

On October 30th, the Israeli cabinet voted to shift the tax burden from the poor and middle class to the wealthy. Prime Minister Benjamin Netanyahu’s cabinet approved the taxation portion of the Trajtenberg report on Sunday, levying heavier taxes on both corporations and the extremely wealthy. Earlier this month, the cabinet approved in principle the […]

Recent Comments