Class Warfare In Graphical Form

For tax day, Mother Jones published a series of graphs showing how taxes and wealth have changed over the last few decades. It’s eye-opening. Here are a few:

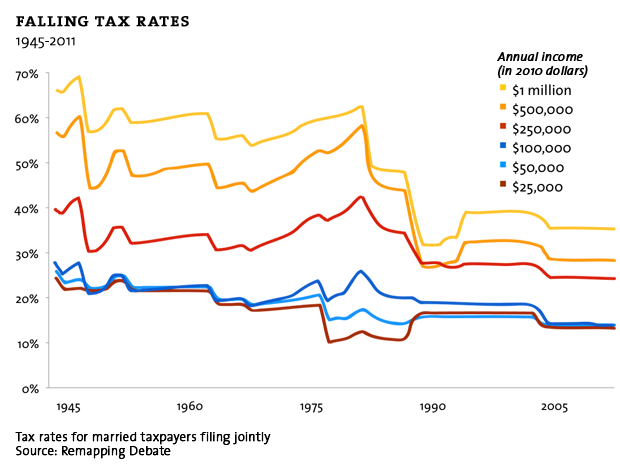

But the superrich don’t pay as much as they used to—and thanks to a combination of tax cuts and preferential tax policies, their tax obligations can be less demanding than the so-called little people’s. In fact, the very wealthiest Americans’ tax burden has been steadily dropping for years, even as they’ve enjoyed astounding income growth not seen by the vast majority of Americans.

Tax rates for the wealthy have fallen substantially since they peaked in the 1940s. During the past 30 years, they have been cut at a much faster rate than middle- and low-income taxpayers’.

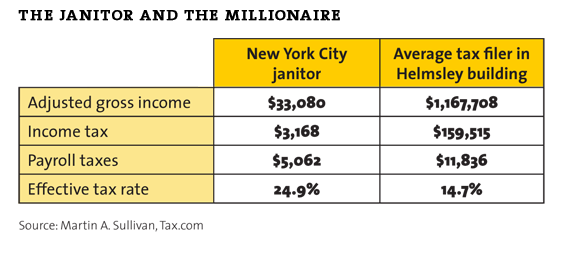

Leona Helmsley’s distaste for paying taxes eventually landed her in federal prison. But the rich have little need to break the law to avoid the tax collector. As Martin A. Sullivan of Tax.com recently calculated, a New York janitor making slightly more than $33,000 a year pays an effective tax rate of nearly 25%. And the effective tax rate for a resident of the Park Avenue building named after Helmsley, earning an average of $1.2 million annually? A cool 14.7%.

Tags: class warfare, taxes

These numbers just don’t pass the smell test.

You can’t believe every pretty graph someone throws up, I mean if you did you might believe Al Gore and man made global warming.

I went to Tax.com and read some of the reader comments, such as this one by LR…..

Posted by LR J on Apr. 19, 2011 at 12:15 AM

First of all Martin, the janitor does not pay the employer payroll tax. The

$2531 is paid for by the employer and therefore does not factor into the

effective tax rate for the janitor. Second of all, there are many deductions

and credits available for the janitor (especially if he has kids and/or

dependents) that would reduce his tax liability and probably give him a tax

refund. I would estimate that somebody with this level of income and one

dependent would receive a tax refund of at least $1,500.

This would leave him with an effective tax rate of at most of 12.7% (

(3168+2531-1500)/33080 ). These calculations ignore the state tax that would of

been taken out of the janitor’s check. Most of which he probably would have

gotten back as a refund.

Learn more about tax before you post these false, misleading statistics.

UI stated that the figures were “eye opening.” Clearly not for people who have had their eyes sewn shut with partisan silk.

Anyway, I come back to my tax day point. Why broke-ass loser Republicans like Galt care so much about what Charlie Copeland pays in taxes always amazes me.

Here is some useful reading for Jason:

http://www.amazon.com/Asking-Right-Questions-Critical-Thinking/dp/0205506682/ref=sr_1_2?s=books&ie=UTF8&qid=1303236179&sr=1-2

“Why broke-ass loser Repulicanss like Galt care so…….” Wow Jason, going a little 4th street on me???

Eye opening ≠ Truth

does anyone else find it hilarious that galty said in the same comment that “you cant trust graphs” which are just statistics in picture from then rested his entire argument on a comment someone left at Taxcom

I dont believe in that junk science! Some guy in the park who was standing on a box and yelling however, has a great point!

hey, John, PLEASE PLEASE PLEASE “GO GALT” take you ball and remove yourself from the civil equation.

First of all Martin, the janitor does not pay the employer payroll tax.

In the example given, the average filer in the Helmsley Building doesn’t pay for his employer’s portion of the payroll tax, either. So if you want to make the calculation the commenter wants (really? you need to troll the comments someplace else to have a comment here?), you have to make it on the Helmsley resident too. So if you are reducing the janitor’s effective rate, you are ALSO reducing the Helmsley resident’s rate. And you can’t just subtract the refund that the janitor got from the calculation without accounting for the deductions that the Helmsley resident got to reduce his or her tax burden.

So let’s not be too quick with admonishments to “critical thinking” until you’ve proven that you’ve mastered the art.

LOL Cass, I was going to post a similar comment. Talk about stacking the deck.

Are you people really this stupid??

You do realize that as an employee, you only pay half of your Social Security tax; your employer pays the other (6.2%) half.

On the pretty graph it’s included as a tax paid by the janitor. As LR points out in his rebuttal, it should not be included.

In Martin Sullivan’s post, he says the average filer in the Helmsley building reported an AGI of 1.7 million. I’m pretty damn sure if you are making 1.7 million you are self employed and hence responsible for the entire 12.2% Social Security tax.

As many other people pointed out in Mr. Sullivans article, he omits many of the tax deductions that may be available to the janitor.

Also lost on everyone here is the simple fact that the Security Guard is only paying $6,579 in taxes while the AF is paying $171,352 per year. In just 2 years the AF will pay more in taxes then the Janitor and Security Guard will in their entire lives.

And the janitor will most likely recieve 10 times what he contributed to social security back while the Helmsley will most likey recieve but less than 10% of what they contributed back when they retire. Also, if I rem right NY is a Democratic city and State where they are setting the tax rate as well as a high sales tax which affects the janitor more too.

So I guess you should punish the Helmsly residents for their hard work and risk they took.

the Security Guard is only paying $6,579 in taxes while the AF is paying $171,352 per year.

When Galty goes out to dinner he orders the steak and lobster while everybody else orders spaghetti, then he wants to split the bill equally.

Are you really so stupid as to actually NOT READ what was written here?

Are you really so stupid as to actually think that the only people making $1.7M are self-employed? In NYC? REALLY?

You wouldn’t have to do this crazy dance if you actually grasped what was being depicted here.

I’m pretty damn sure if you are making 1.7 million you are self employed

And I’m pretty damn sure you don’t know what you’re talking about. For instance, Anderson Cooper makes 2 million a year and isn’t self employed. CEOs are the easy call, but you’ll find that those tiers underneath the CEO will make this much and more. Bankers come to my mind, as well.

Anyone recall the average bonus at Goldman Sachs was for 2010? Around $400,000. How many New Yorkers work there? I don’t know.

And that was AFTER paying a $500,000,000 fine where no one went to jail or admitted wrong doing and they also put $500,000,000 in Goldman’s SACK.

Not ONE fucking indictment.

Here’s a tidbit the Helmsley numbers give us:

If these millionaires are paying $11836 in wage tax (2 x 5918), that means they are declaring taxable wages of $88,992.

All the rest of their income ($1,078,716) is apparently unearned income not subject to wage tax at all.