Playing Chicken with the Debt Ceiling

Business Week provides a Must Read analysis of the current state of the Debt Ceiling debates. They seem to be endorsing whatever the Gang of Six is doing — that they are calling for a “centrist” position probably means that what comes out of this will be anything but. Look for more of this kind of thing as the business community makes it really, really clear that defaulting on the debt is simply not an option. But you can see from this why I think that the President has the best winning hand he will ever get on a fiscal issue. All he has to do is keep telling the world he is looking for a clean bill from the House. He doesn’t have any responsibility here other than signing it. The business community will make sure the Republicans go along for the ride.

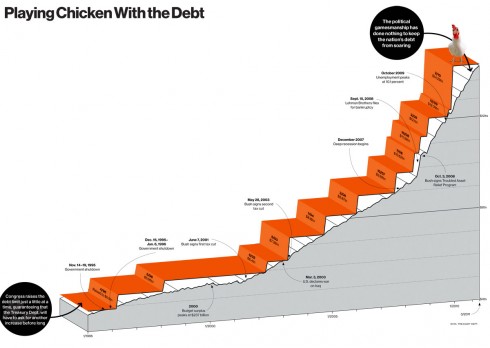

This article is accompanied by a really great graphic — you can see who is responsible for building this debt — (click for way bigger version):

On the bright side, Bush’s wars, TARP and tax cuts for the wealthiest Americans has been a boon for the nation’s graph makers.

and Obama isnt doing so bad himself with about 2 trillion in the 16 months in office. Oh yeah and we are about to get into another way, no its called Consultants, not soldiers. And didnt everyone get a tax cut under Bush? even us common folks get a child credit? They should have let the Banks fail. The TARP was so wrong that Obama kept Geitner and Bush’s economic team on. This country is like giving my college age kid a credit card and he goes out and drinks till he hits his max. Then he approached me and ask me for more credit, we fight, he cuts one cup of Starbucks from his monthly allowance, and I increase his limit, without asking for any cuts in his spending nor will he get a better paying job.

Way to go, sockpuppet. Another Republican who can’t manage the numbers.

Lets see 14.29 as of 2/10 and 12.39 as of 12/09. Thats pretty close to 2 Trillion? so where are my number wrong? You still have vasoline on that sock of yours?

You are too close to your sock puppetry to see it. Befor you cut out your sons coffee take a hard look at your parenting skills.

exactly, you make my point very well. You are indeed a Republican. Stop spending what you dont have. So who was Obama’s parents? Who does he listen to? oh yeah his friends on Wall Street. Goldman Sach. So if my parenting skills are so bad, why do we keep having to raise the debt ceiling? I didnt like it when Bush did it. And I certainly dont like it now that is growing it exponentially

We keep raising the debt ceiling because we still are not paying for all of the wars and tax cuts you people think are free. The day you join the bandwagon to cut off both is the day you get to be serious about the “stop spending what you don’t have” BS.

Democrats in the House are getting themselves organized to require a clean bill to raise the debt ceiling. Probably a good time to reach out to John Carney as ask him to get on board if he hasn’t already.

Funny about the wars and the tax cuts. The wars were voted on and clearly won in both houses, with a majority of D’s at the time, also the tax cuts were passed by a D majority as well. And they also helped us small guys quite a bit as well. And didnt Obama just sign a bill for tax cuts this year, a smaller percentage of the SS payment?

Also, I agree we need to cut the Defense budget, cut Medicare, cut SS, cut all entitlements.

Look what the raising of the debt ceiling has done? S&P are giving us a heads up that they may reduce our rating to the losest since the beginning of WWII.

We must cut everywhere. Also I wouldnt mind paying more in taxes if it was just to go to pay down the debt. But once we start paying more, the politician get the money and never return it.

Im waiting on Coons’ NCC to lower property tax once the real estate market pick up and the transfer tax starts coming in again.

Doubt that will ever happen?

But I am sure you dont mind paying more do you?

Who voted for the wars isn’t exactly material to the fact that you aren’t asking for a roll back of the major drivers of the current debt. And you would join all of the pols who voted for this stuff — all of whom have decided that now they need to be concerned about the deficit. When they didn’t care about it when it was being created.

And the only people paying attention to the S&P business are pols trying to get some advantage, the media who are clueless and people like you who think that the S&P means something. The people buy and sell this stuff haven’t given it a second look, as you can tell by the state of the bond markets over the past two days.

ps. Chris Coons is no longer NCCo Executive, so he won’t be here reducing or raising anybody’s taxes for awhile. No wonder you are so confused.

so we have a deficit- reduce spending….raise taxes with a specific end in mind ie pay down the debt to a particular point, then the taxes go back to the point where they are now.

Why do you think you can keep raising taxes and I will keep paying them. I dont want the things, the waste that the government is spending. Did you take advantage of all your exemptions, all the loop holes that you were entitled to? Did you pay the max amount of taxes?

BTW I know Coon’s isnt in office, but how hard is it to balance a budget when you raise taxes by 100%? and no I am not confused. Just confused about why we have to keep raising the taxes, why the government cant live within their means. The growth in the government employees far outstrips any index out there.

“Why do you think you can keep raising taxes and I will keep paying them?”

You are only paying $3,000 on the measly $30k you make at Wawa. It is the lowest tax rate in the industrialized world.

” I dont want the things, the waste that the government is spending. ”

Except wars.

“I dont want the things, the waste that the government is spending.”

you dont want roads? you dont want a police dept and a fire dept? i swear, the libertarians get dumber every year.

These bozos live in mortal fear that a dime of tax money might go somewhere besides the defense department.

like to “those people”

Jason 330- your first post here is sublime.I tip my cap.

My points have been covered well here by my buddies.

One question.

What the hell does Vaseline have to do with socks as “good one” infers cassandra_m has on hers?

I’m stumped.

Why Obama should pay more in taxes

Reuters 4/20/2011 Gregg Easterbrook

President Barack Obama wants to increase taxes on the wealthy, and surely is correct that this must be part of any serious plan to control the national debt. Consider the case of a wealthy couple who made $1.7 million in 2010, yet paid only 26.2 percent in federal income taxes — though the top rate supposedly is 35 percent, and the president says that figure should rise to 39.6 percent. The well-off couple in question is Barack and Michelle Obama, whose tax returns, just released, show they paid substantially less than the president says others should pay.

If Obama is in earnest about wanting increased taxes on the wealthy, then he should send the United States Treasury $182,998. That’s the difference between his Form 1040 Line 60 (“This is your total tax”) and what he would have owed at the higher rate (plus limits on itemized deductions) he himself advocates.

So why doesn’t he tax himself more? The Form 1040, after all, only stipulates the minimum tax an American must pay. More is always welcome. Obama should write a check to the United States Treasury for $182,998.

PS The Dear Leader voted against raising the debt ceiling last time.

Well, here’s “The Change”. How do you like it so far?

IT HAS ONLY BEEN 2 YEARS!

Two years ago January, Barack Obama was inaugurated as president of the United States .

Are you better off today than you were two years ago?

Numbers don’t lie, and here are the data on the impact he has had on the lives of Americans:

January 2009 TODAY % chg Source

Avg. Retail price/gallon gas in U.S. $1.83 $3.79 69.6% 1

Crude oil, European Brent (barrel) $43.48 $108 127.7% 2

Crude oil, West TX Inter. (barrel) $38.74 $91.38 135.9% 2

Gold: London (per troy oz.) $853.25 $1,369.50 60.5% 2

Corn, No.2 yellow, Central IL $3.56 $6.33 78.1% 2

Soybeans, No. 1 yellow, IL $9.66 $13.75 42.3% 2

Sugar, cane, raw, world, lb. Fob $13.37 $35.39 164.7% 2

Unemployment rate, non-farm, overall 7.6% 9.4% 23.7% 3

Unemployment rate, blacks 12.6% 15.8% 25.4% 3

Number of unemployed 11,616,000 14,485,000 24.7% 3

Number of fed. Employees, ex. Military (curr = 12/10 prelim) 2,779,000 2,840,000 2.2% 3

Real median household income (2008 v 2009) $50,112 $49,777 -0.7% 4

Number of food stamp recipients (curr = 10/10) 31,983,716 43,200,878 35.1% 5

Number of unemployment benefit recipients (curr = 12/10) 7,526,598 9,193,838 22.2% 6

Number of long-term unemployed 2,600,000 6,400,000 146.2% 3

Poverty rate, individuals (2008 v 2009) 13.2% 14.3% 8.3% 4

People in poverty in U.S. (2008 v 2009) 39,800,000 43,600,000 9.5% 4

U.S. Rank in Economic Freedom World Rankings 5 9 n/a 10

Present Situation Index (curr = 12/10) 29.9 23.5 -21.4% 11

Failed banks (curr = 2010 + 2011 to date) 140 164 17.1% 12

U.S. Dollar versus Japanese yen exchange rate 89.76 82.03 -8.6% 2

U.S. Money supply, M1, in billions (curr = 12/10 prelim) 1,575.1 1,865.7 18.4% 13

U.S. Money supply, M2, in billions (curr = 12/10 prelim) 8,310.9 8,852.3 6.5% 13

National debt, in trillions $10.627 $14.052 32.2% 14

Just take this last item:

In the last two years we have accumulated national debt at a rate more than 27 times as fast as during the rest of our entire nation’s history. Over 27 times as fast! Metaphorically, speaking, if you are driving in the right lane doing 65 MPH and a car rockets past you in the left lane 27 times faster . . . It would be doing 1,755 MPH! This is a disaster!

Sources:

(1) U.S. Energy Information Administration; (2) Wall Street Journal; (3) Bureau of Labor Statistics; (4) Census Bureau; (5) USDA; (6) U.S. Dept. Of Labor; (7) FHFA; (8) Standard & Poor’s/Case-Shiller; (9) RealtyTrac; (10) Heritage Foundationand WSJ; (11) The Conference Board; (12) FDIC; (13) Federal Reserve; (14) U.S. Treasury

Notwithstandng that those stats don’t mean much, cutting and pasting other people’s content in its entirety is not done here — it is a violation of Fair Use. Edit that back and provide a link ASAP.